Abstract

- Apple Pay, Samsung Pockets, and Google Pay make contactless funds quick and straightforward.

- It permits motion of cash between linked accounts and extra flexibility in funds.

- Apple Pay means that you can monitor orders, bundle purchases, use rewards factors, and pay straight from iPhone to iPhone.

One of the ingenious innovations over the previous 20 years is with the ability to pay with out even taking out your pockets. Using your phone to faucet on a contactless cost reader and go about your day makes the method a lot smoother. Storing your credit card data in your cellphone can appear scary, however the added safety in these options could make it a lot easier total.

Apple Pay is the premiere approach to do that for iPhone customers and only a few clicks on the facet button will allow you to go about your day. Apple Pay, Samsung Wallet, Google Pay, and extra are fast and environment friendly methods to get via traces and on along with your life. Apple Pay is extra broadly accepted as of late, so it is an optimum strategy to pay for issues.

Associated

How safe is Apple Pay really?

As a rule, any safety threats are oblique fairly than by way of Apple Pay itself.

Whereas the essential performance of Apple Pay may appear simple, there are literally a number of further options designed to make your expertise smoother. Apple Pay presents rather more than simply tap-and-pay — so to actually get essentially the most out of Apple Pay and see the way it can simplify your routines, hold studying.

iPhone 16 Professional Max

Apple’s iPhone 16 Professional line options a number of notable upgrades over final yr’s iPhone 15 Professional, together with a devoted digicam button, a brand new A18 Professional chip, a much bigger display screen, and several other AI-powered Apple Intelligence options.

1 Transfer cash round in Apple Pay

Transferring funds has by no means been simpler

Apple / Pocket-lint

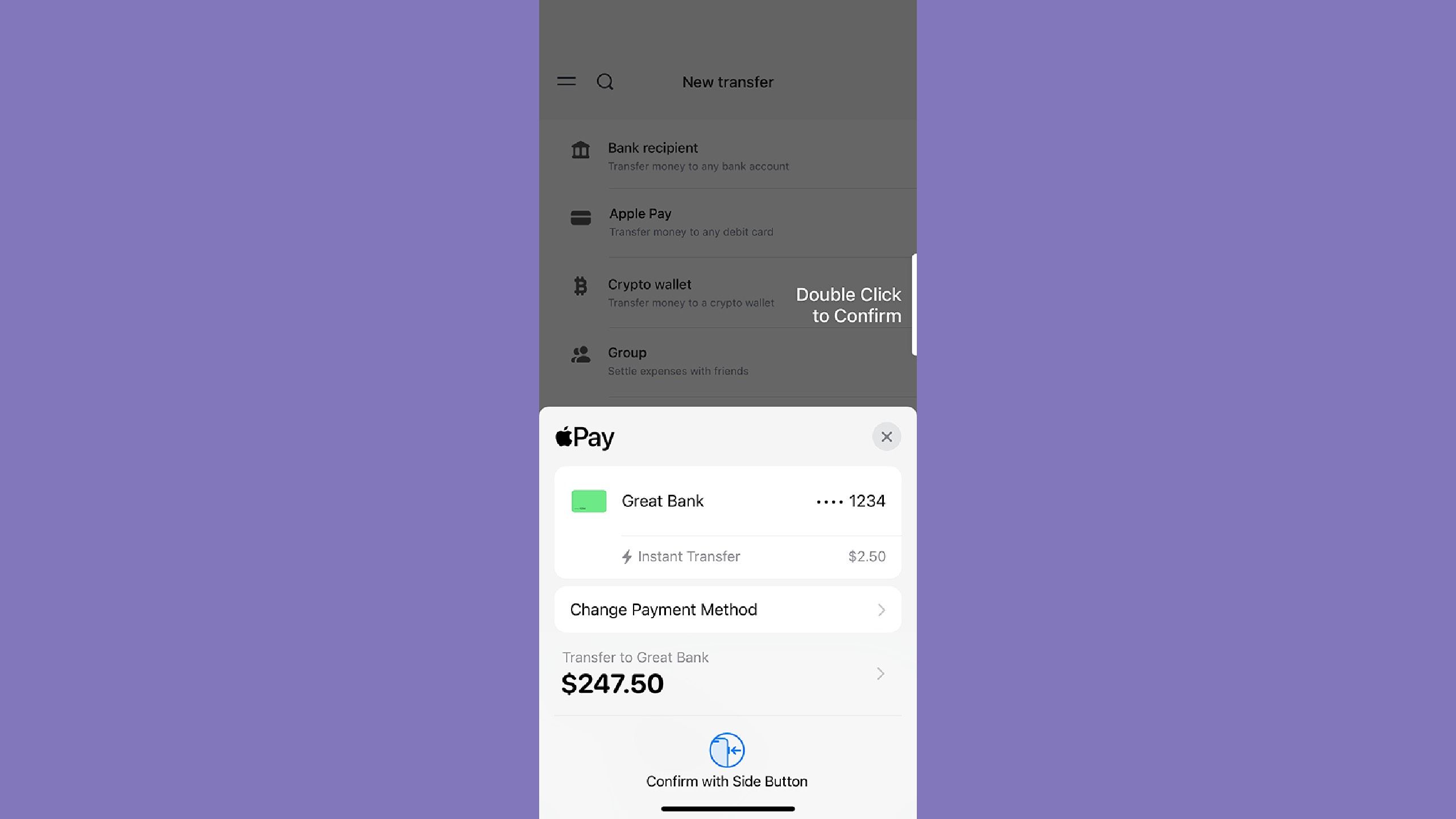

You now not have to bodily go to your financial institution and even open up your financial institution’s cellular app to switch funds. With Apple Pay, you probably have a checking account or card linked to your Apple Pockets, you possibly can transfer cash between them with only a few faucets — no particular request vital.

This works for debit playing cards, bank cards, financial savings accounts, and checking accounts. Chances are you’ll incur charges if you happen to’re shifting cash from a bank card to a checking account, for instance, however you may have extra entry to cash to have the ability to pay for extra out of your Apple Pay whenever you set it up.

There could also be a charge to have the funds accessible instantly versus having them accessible in 24 hours, relying in your financial institution.

Associated

Apple Pay gets new flexible payment integration and announces big upgrade coming in 2025

Apple has introduced PayPal is coming to Apple Pay subsequent yr. New cost plan choices are additionally accessible now.

2 Observe your order simply

Something you purchase will present up

Apple / Pocket-lint

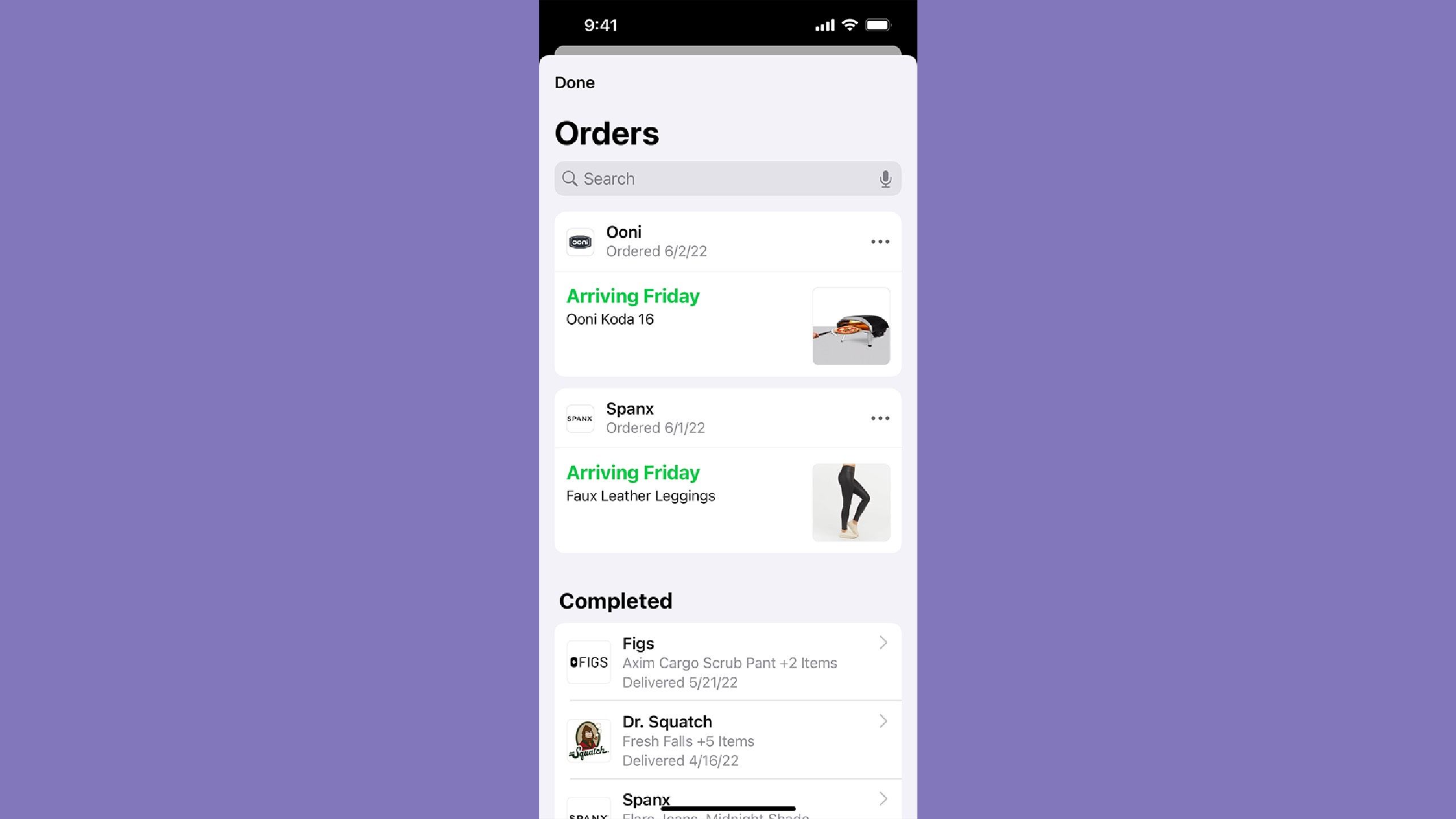

Anytime you purchase one thing with Apple Pay on-line, you possibly can monitor the orders. Beforehand, if you happen to bought one thing with Apple Pay, you’ll then need to depend on an electronic mail or a affirmation quantity to go and verify the order standing. However now, all that data is definitely saved inside Apple Pockets, letting you see a operating record of your purchases and the place every of them may be within the success course of.

This may solely occur as soon as cost is full, so if you happen to’re paying on a cost plan, it could not work. However Apple Pockets could have any open orders present up on the prime of the app, and clicking into it provides you with buying particulars, delivery data, affirmation numbers, and extra.

You’ll be able to even message the retailer via it.

Associated

Amazon One uses your palm for contactless payments

Amazon has introduced a contactless cost system that does not want a card nor cellphone. As a substitute, Amazon One can learn your palm to allow funds.

3 Bundle your purchases

Pay for all of it at one time

Apple / Pocket-lint

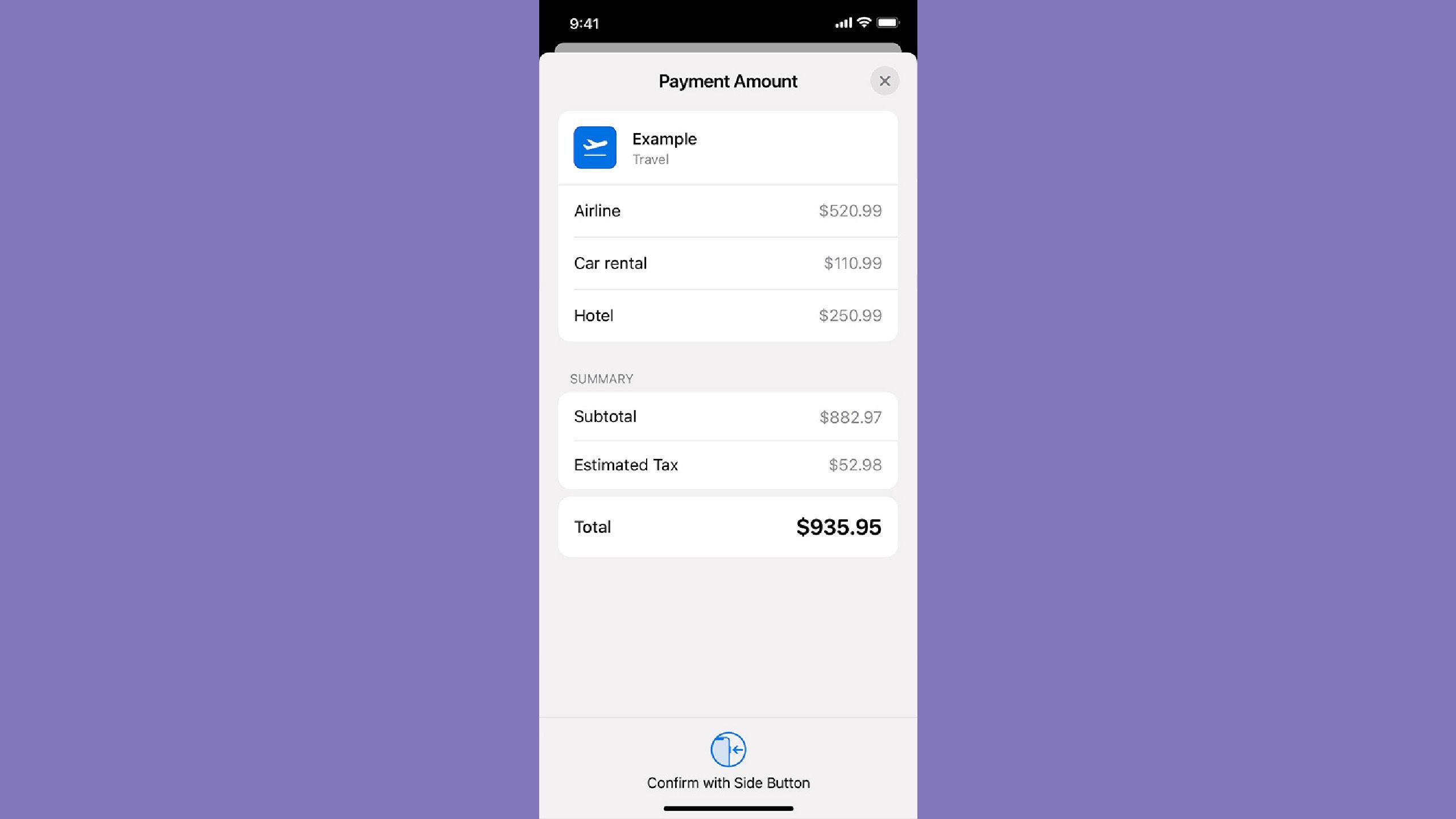

To illustrate you are reserving a visit utilizing a web site like Expedia or Kayak, and also you’re buying each a rental automotive and a aircraft ticket. As a substitute of creating two separate transactions, Apple Pay allows you to pay for each in a single go. This feature is accessible on some web sites that allow you to pay for purchases from completely different retailers concurrently.

It’s going to present up on one cost sheet and allow you to double-check a number of purchases directly earlier than you hit ship. As soon as they’re bought, all of them will present up individually as their very own orders in Apple Pockets, so you possibly can monitor them. This is not provided by a number of retailers — primarily ones you’d anticipate to hyperlink a number of retailers collectively, resembling these journey websites. However it’s a handy choice.

Associated

Apple CEO Tim Cook teases incoming ‘Apple Launch’ that’s probably the iPhone SE 4

The reveal of Apple’s iPhone SE 4 is probably going simply across the nook.

4 Use factors to buy

Put these incentive packages to make use of

Apple / Pocket-lint

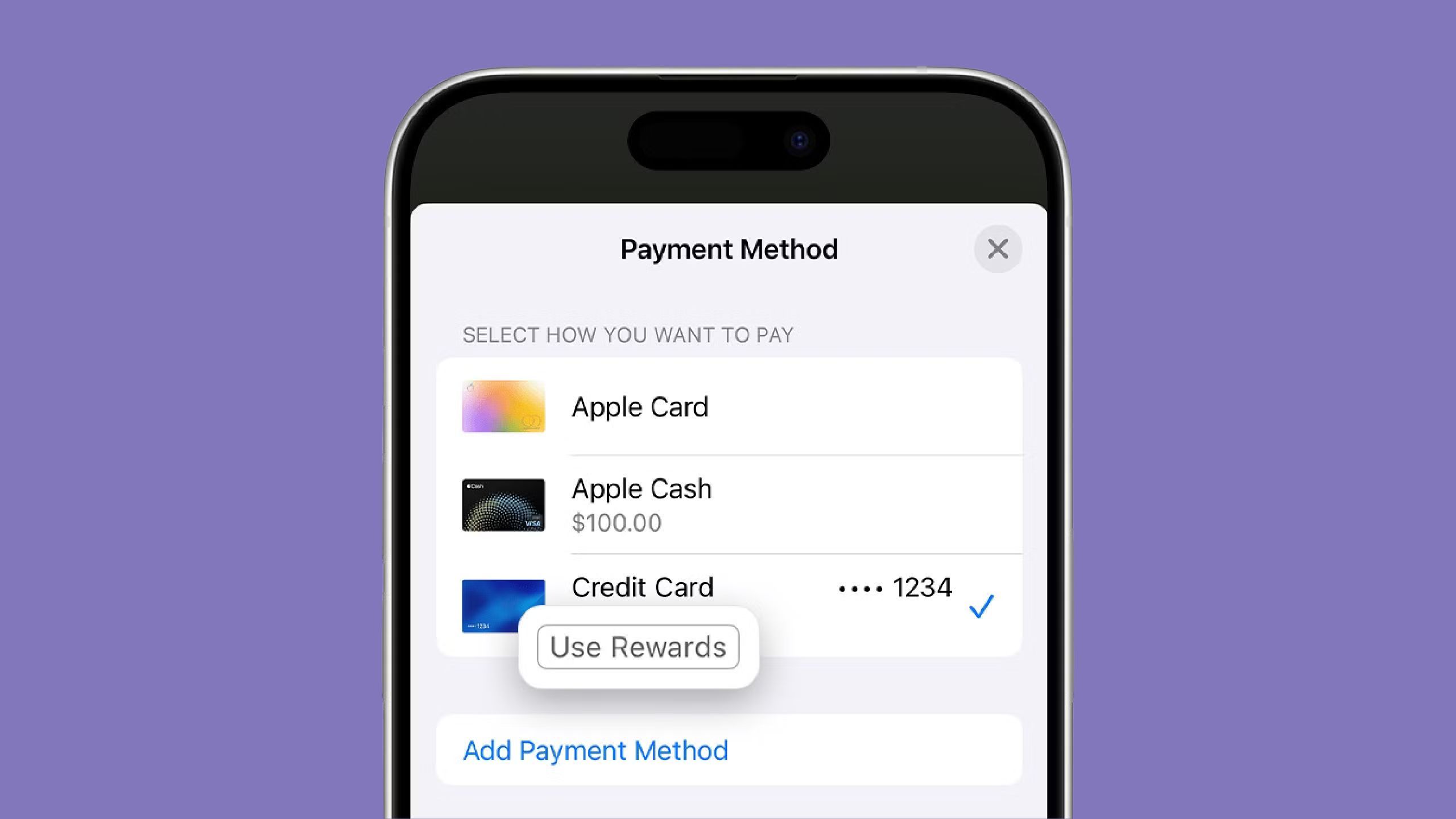

Many retailers assist you to use bank card rewards when making purchases, which is without doubt one of the perks of purchasing on platforms like Amazon. Apple Pay presents the same profit — whenever you add your card to Apple Pay, there’s nothing additional it’s essential do. In case your card comes with rewards, and so they’re appropriate with Apple Pay, they’ll routinely seem in your cost choices.

To make use of rewards in Apple Pay,

- Open Apple Pay.

- Faucet on a bank card that you’ve got that gives rewards or factors.

- In case you’re ready to make use of the rewards in Apple Pay, a bubble will pop up that claims Use Rewards. Faucet that.

- Enter the quantity you need to use. You’ll be able to pay for it solely in factors or partially, relying on the quantity of rewards you will have.

- Faucet Achieved and make sure the cost.

You may also view your rewards steadiness in Apple Pockets. The rewards steadiness will present up under the cardboard. It should additionally present you the latest redemption of factors or rewards.

All that data is saved inside Apple Pockets, permitting you to see a operating record of your purchases and the place every of them may be within the success course of.

Associated

How to save, edit, and delete credit cards in Autofill on iPhone

If you wish to simply declutter all of the cost strategies saved in your iPhone, you simply have to discover ways to handle your Autofill information.

5 Pay iPhone to iPhone

There is no want for a reader

Apple / Pocket-lint

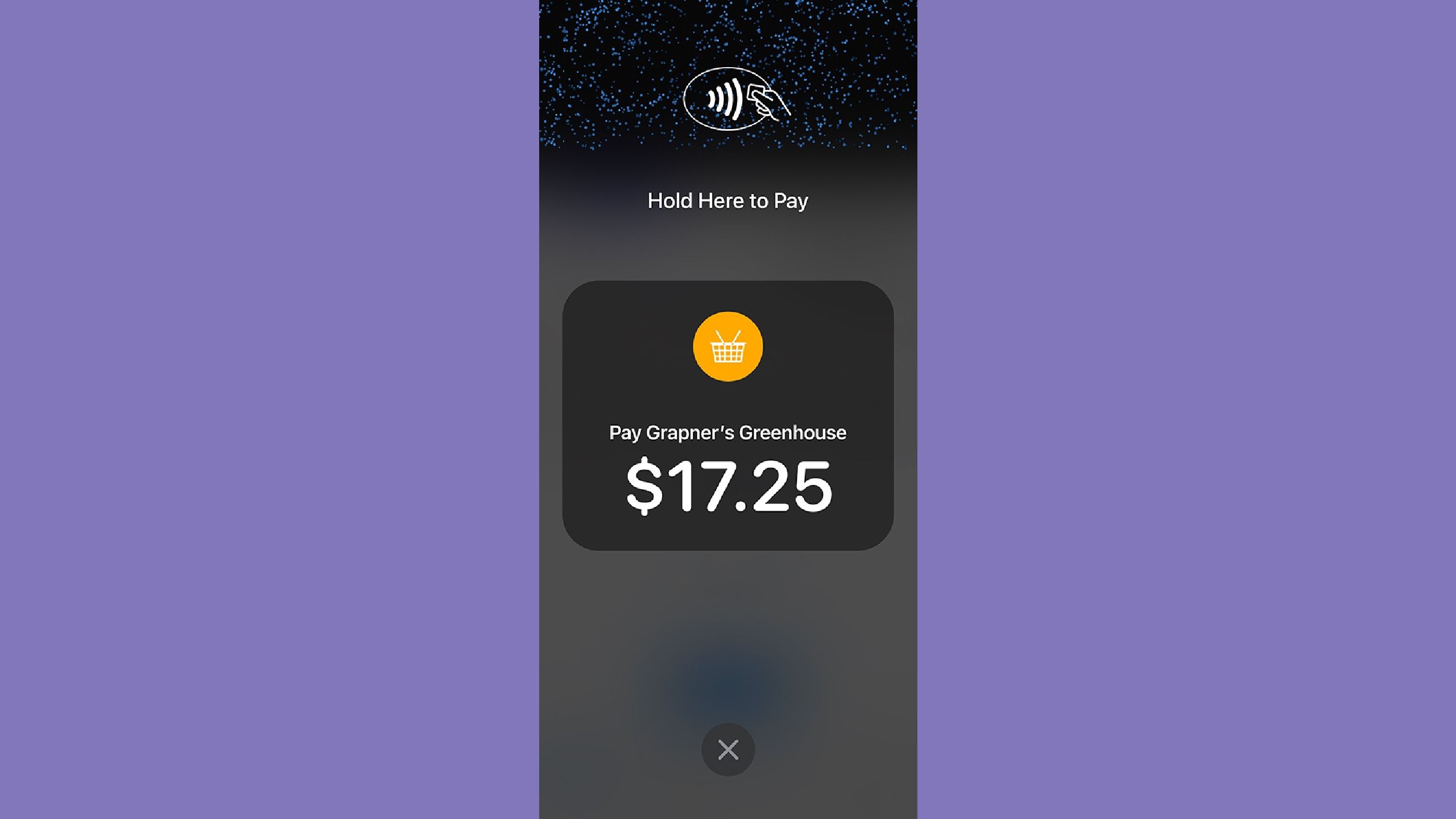

You’ll be able to truly keep away from utilizing a reader if the service provider you are buying from has an iPhone. They’ll sync up with a cost app, resembling CashApp, Venmo, Zelle, or one other app, and open up the cost plan via that. They’ll current an iPhone that may act as an Apple Pay reader, and also you — because the buyer — can simply faucet your iPhone to finish the transaction.

Due to Apple’s sturdy safety measures, it is truly fairly safe. Everytime you’re able to pay, simply search for the wi-fi card reader icon on the prime of the product owner’s iPhone to verify it is prepared for a cellular cost. Additionally, you possibly can confirm the right value has been entered by the service provider earlier than you authorize the cost. This can be easier than some shops that simply inform you what the value is and do not give you a receipt.

Associated

Report shows iPhone owners are getting rid of their phones faster

Persons are upgrading their iPhone quicker than earlier than, a brand new report finds.

Trending Merchandise

Acer KB272 EBI 27″ IPS Full H...

ASUS RT-AX55 AX1800 Dual Band WiFi ...

Wi-fi Keyboard and Mouse Combo, 2.4...

Nimo 15.6 FHD Pupil Laptop computer...

Acer CB272 Ebmiprx 27″ FHD 19...

ASUS 15.6” Vivobook Go Laptop com...